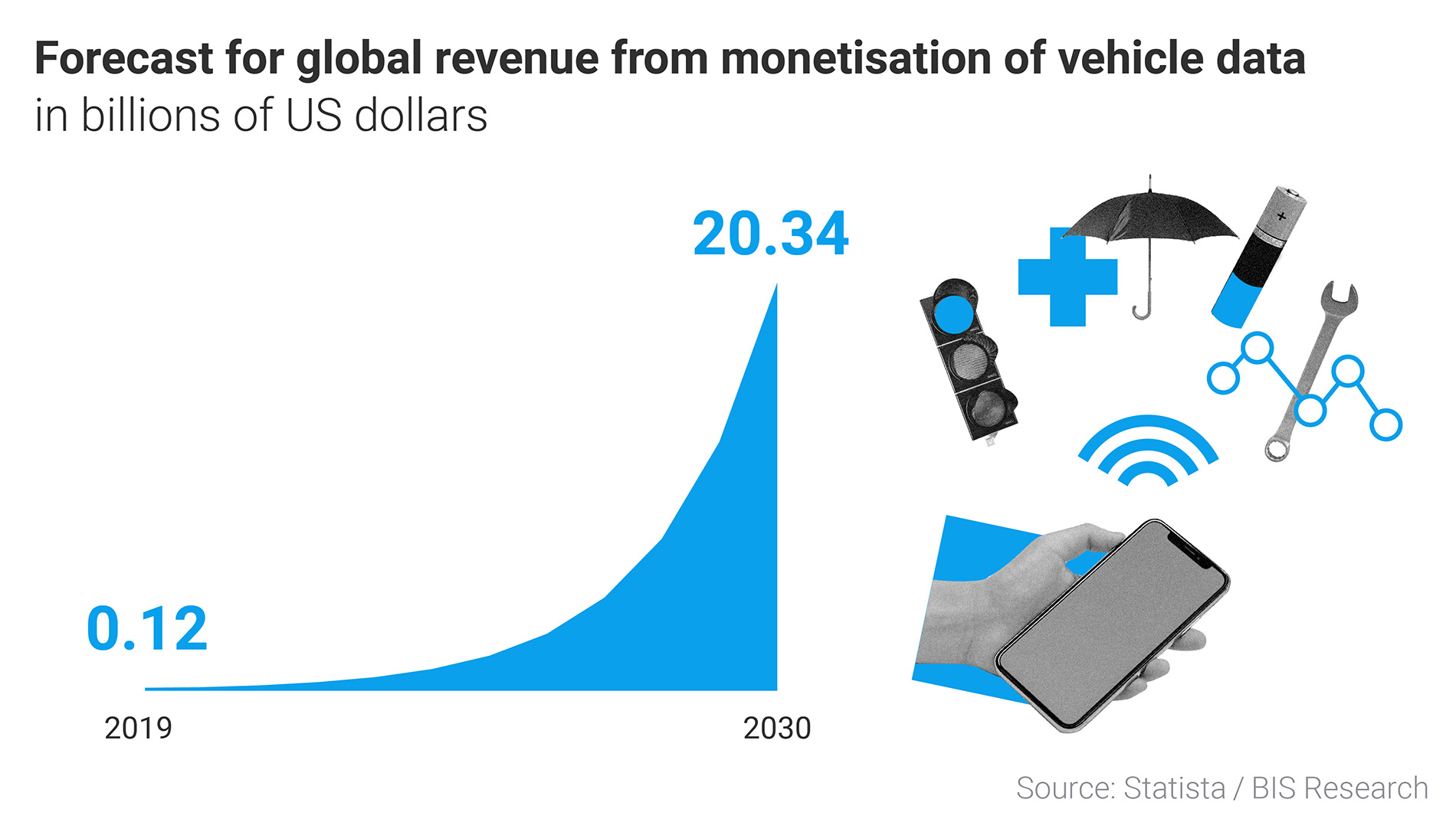

An exploding market

The sales revenue from connected cars and use of their data is forecast to rise to over 20 billion US dollars by 2030. ‘The monetisation of data is becoming ever more important against the background of declining profits from the traditional car business,’ say the authors of a McKinsey study. Data from connected vehicles can help create new business fields, such as the integration of purchasing, financing and insurance that covers the entire life cycle of the vehicle, automated fleet management and mobility-as-a-service. As the costs of data collection, conversion and use fall over time, new potentials will emerge on an ongoing basis.

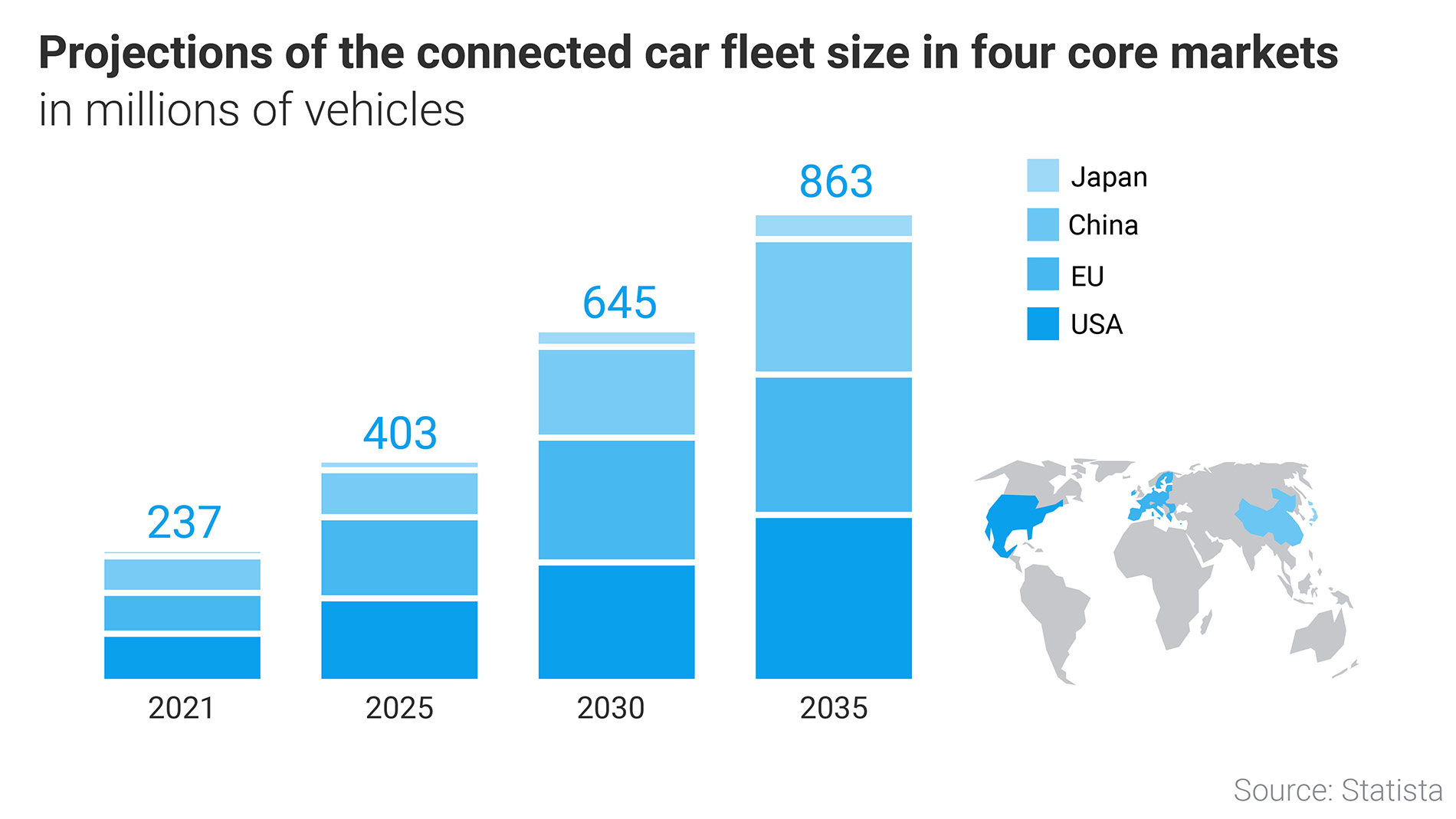

By 2030, 96 per cent of new cars will be connected

Over the coming years, the number of connected cars globally is likely to triple. In 2021, there were approximately 84 million connected cars on the road in the USA. By 2035, this figure is expected to exceed 305 million, making the USA the biggest market for connected cars. In the EU, EFTA countries and the UK, around 44 million vehicles are already connected. Connectivity services in connected cars are particularly heavily used in China at 90 per cent.

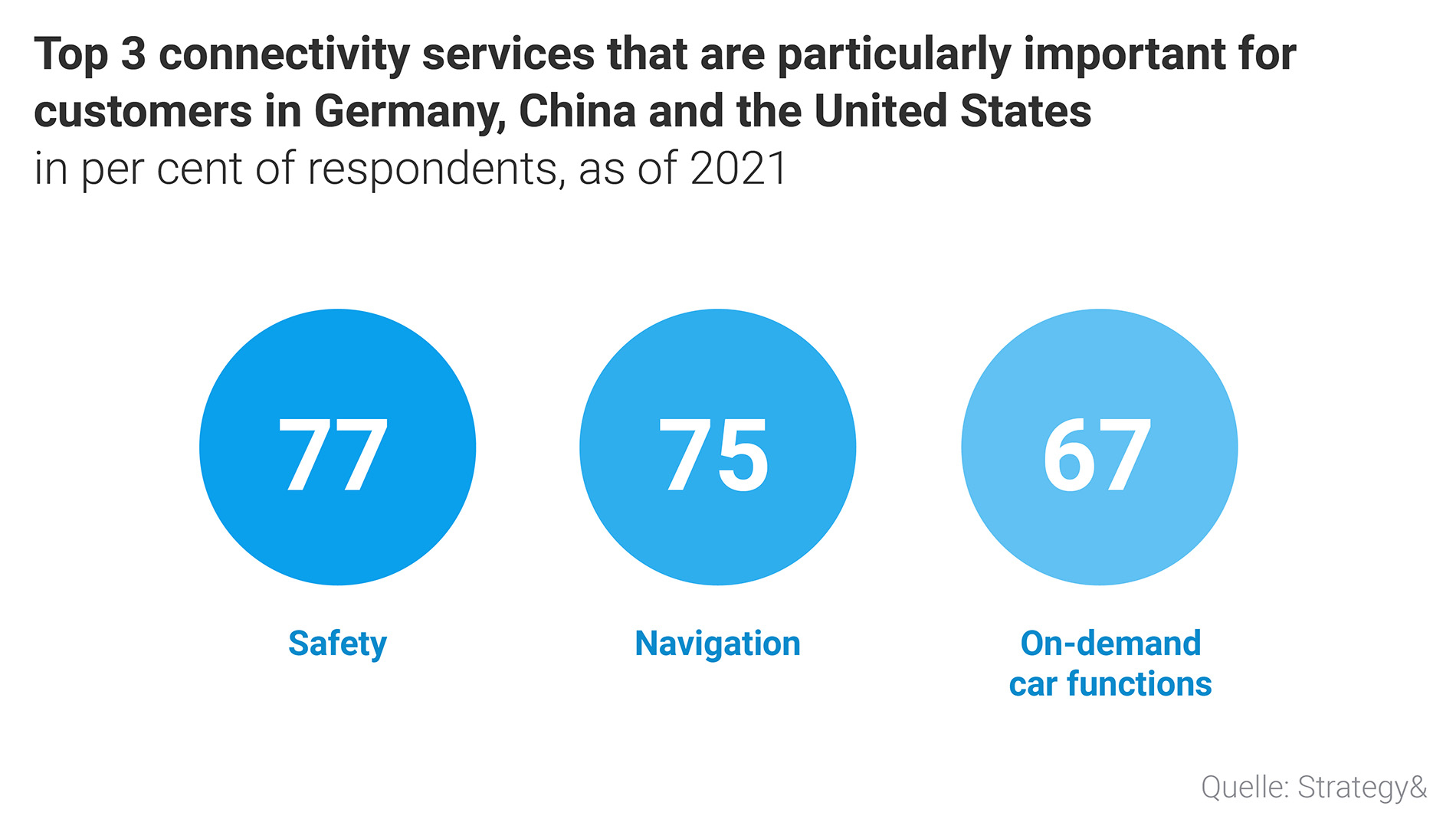

What services are in demand?

In 2021, respondents in the USA, China and Germany regarded safety and navigation to be the most important services in connected cars. In contrast to the USA and Germany, for the Chinese, lifestyle and comfort were also high on the list. Fully equipped connected cars have more than 100 sensors on board that measure technical data, adjust consumption and range, help with parking or initiate emergency braking. This kind of connectivity is also giving rise to new mobility concepts such as sharing models. As the automation of driving progresses, such models will become even more important.

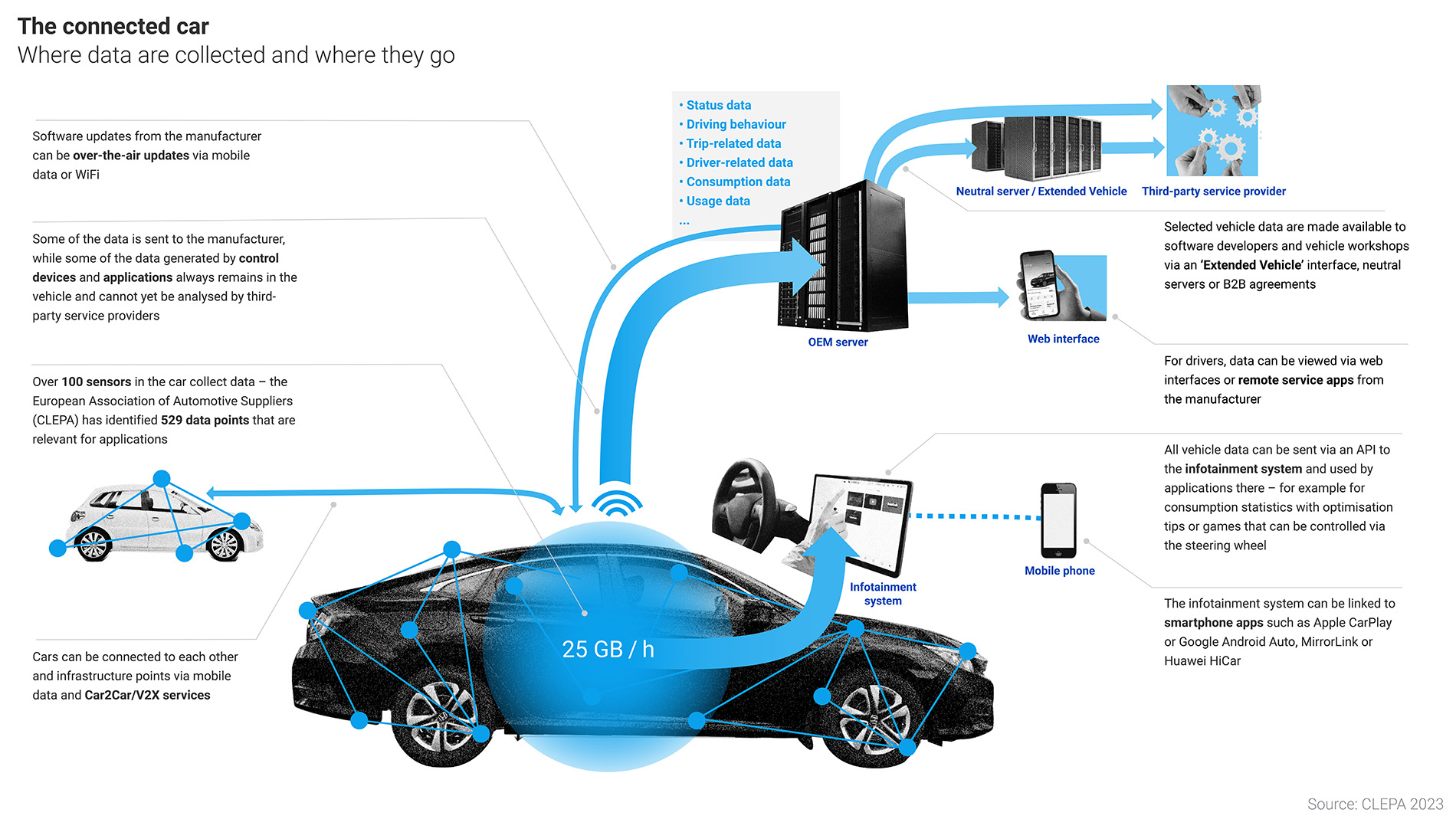

25 GB per hour – but what happens to the data?

‘What is important is transparency regarding the available data for each vehicle, fair access to data and resources for all market participants and a common dataset that all vehicles support as far as possible, provided the technical prerequisites are met.’

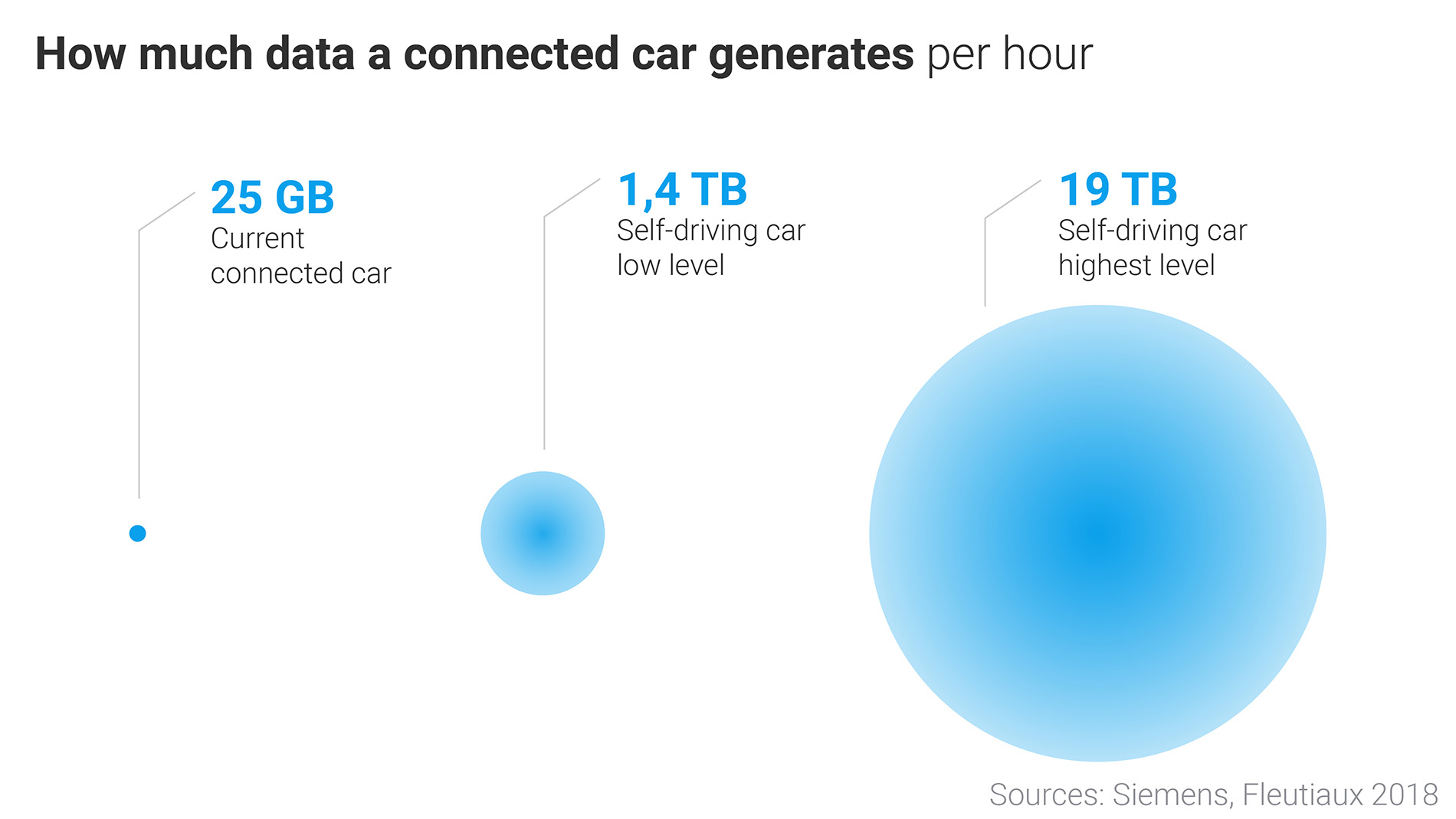

Data boost from autonomous driving

Today’s cars are already data centres on wheels. Autonomous cars will generate far more data – each one up to 19 terabytes per hour which works out per year as more than the data generated by Twitter’s 360 million users. How much of these data, which are based on the 5G mobile communications standard, are actually useful? What can be deleted? Where should they be processed and how long should they be saved? Until this is clarified, we can use the time to develop useful applications. These include predictive maintenance in car production, ‘pay as you drive’ insurance and intelligent traffic lights that recognise emergency vehicles.

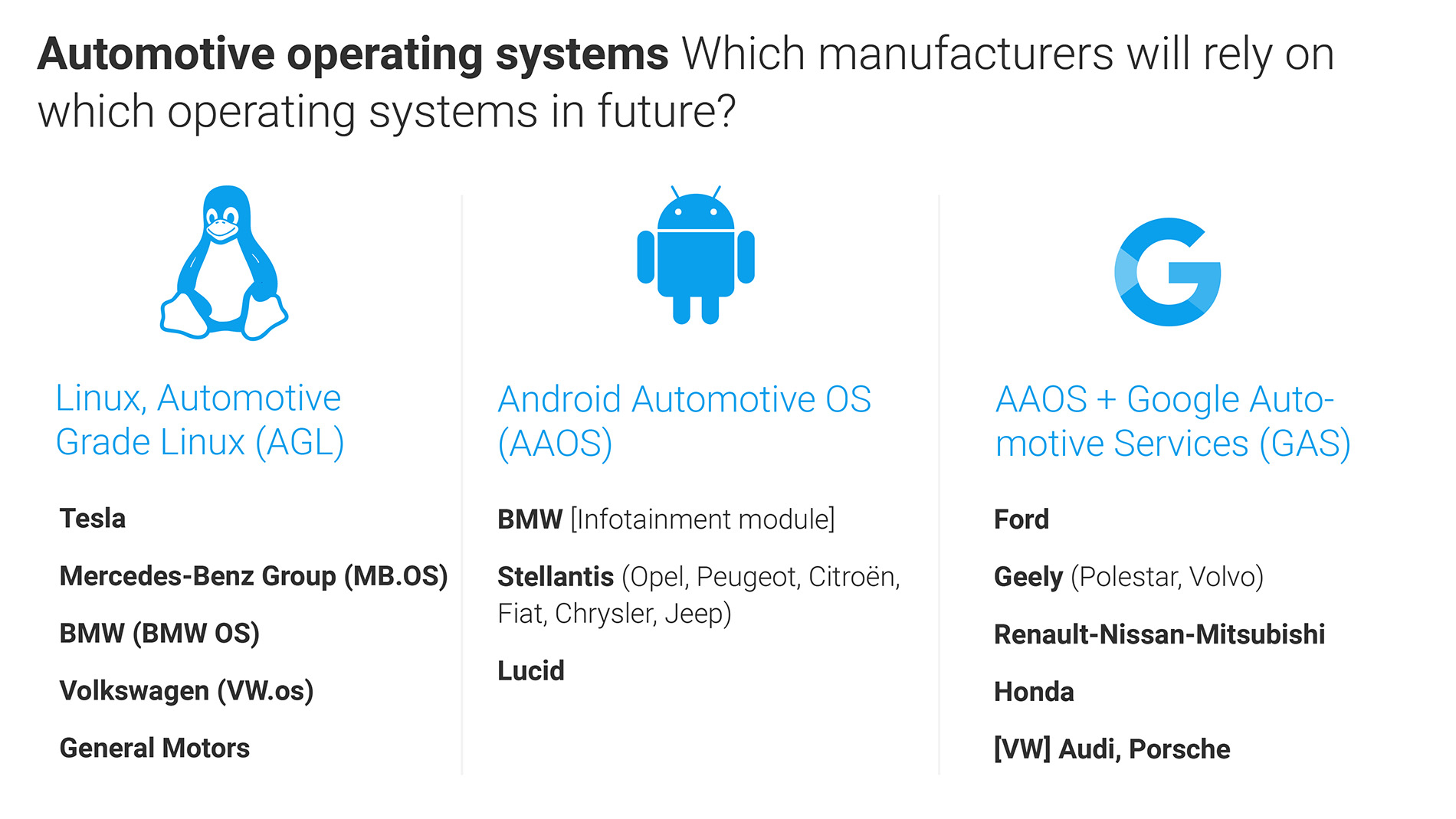

Everyone wants to get in the car: the battle of the operating systems

The competition for operating systems in cars is in full swing. Car manufacturers are developing their own software but are in direct competition with US software giants. The obstacle here for market participants is that buyers are used to their smartphones and apps such as Google maps. Blackberry QNX, one of the first leading automotive operating systems, recently lost market shares in the infotainment segment, while Google's Android Automotive and Automotive Grade Linux (AGL) both grew and are projected to do well. A key factor in this battle is partnerships with the car manufacturers. A trend towards Android began when Ford switched from QNX to Android with Google Services at the start of 2021.

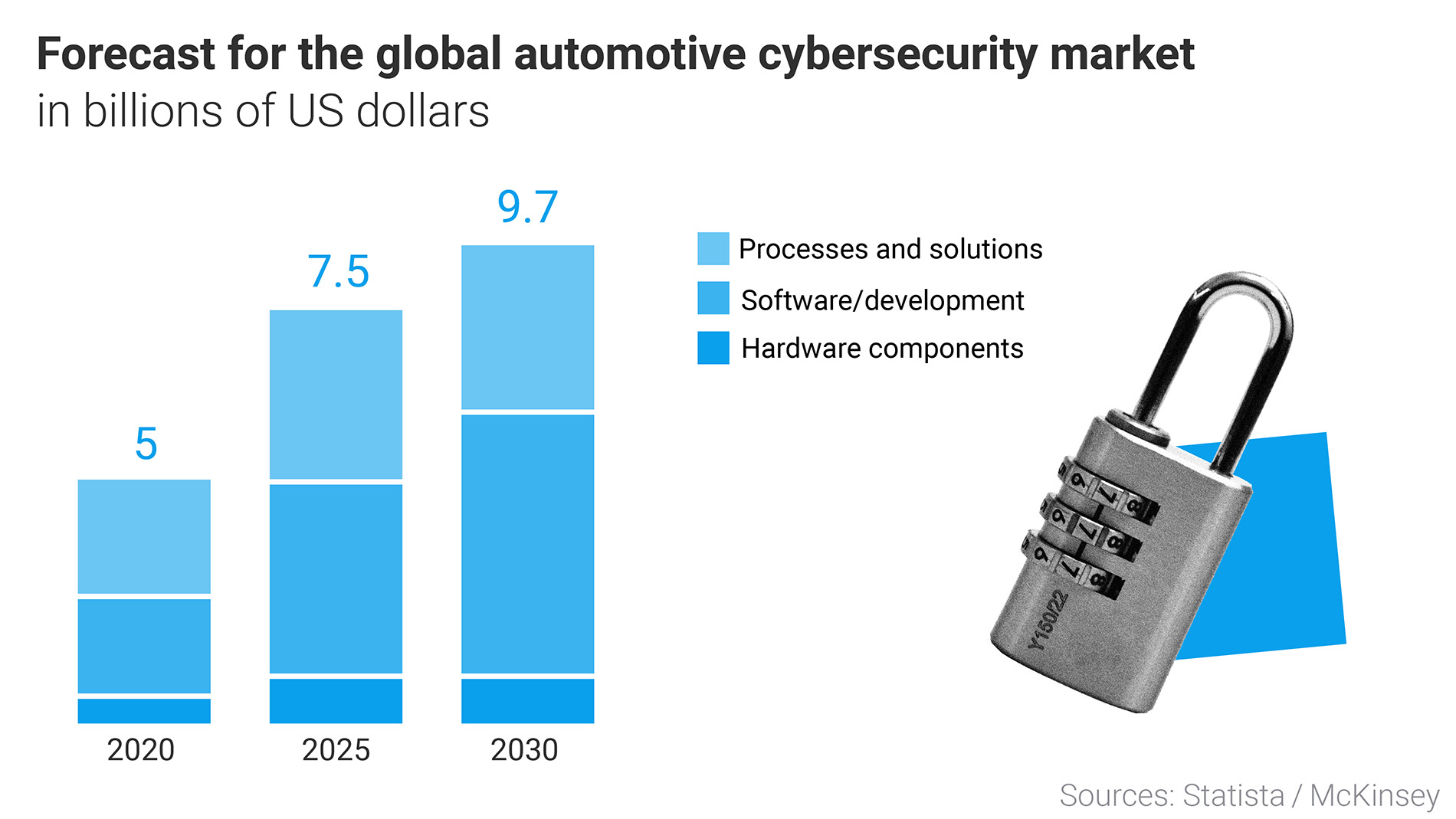

The cybersecurity market

Cybersecurity in the digital car is about the risk of information being tapped. The current regulatory framework for manufacturers offers good guidance when it comes to designing relevant measures for vehicles in operation. By contrast, the vehicle is much less protected during production when additional components could be added to the vehicle or existing ones manipulated. Manipulation is also possible via WiFi and mobile data interfaces. With the EU Secure Remote Maintenance Information (SERMI) initiative, manufacturers are now required to give third parties the opportunity to offer security-critical services. There is a special focus on securing diagnostic functions that enable vehicle software to be updated. As the various subfields of security are all interlinked, functional security and cybersecurity must be appraised and developed in an integrated manner.