5 factors in the proliferation of e-mobility

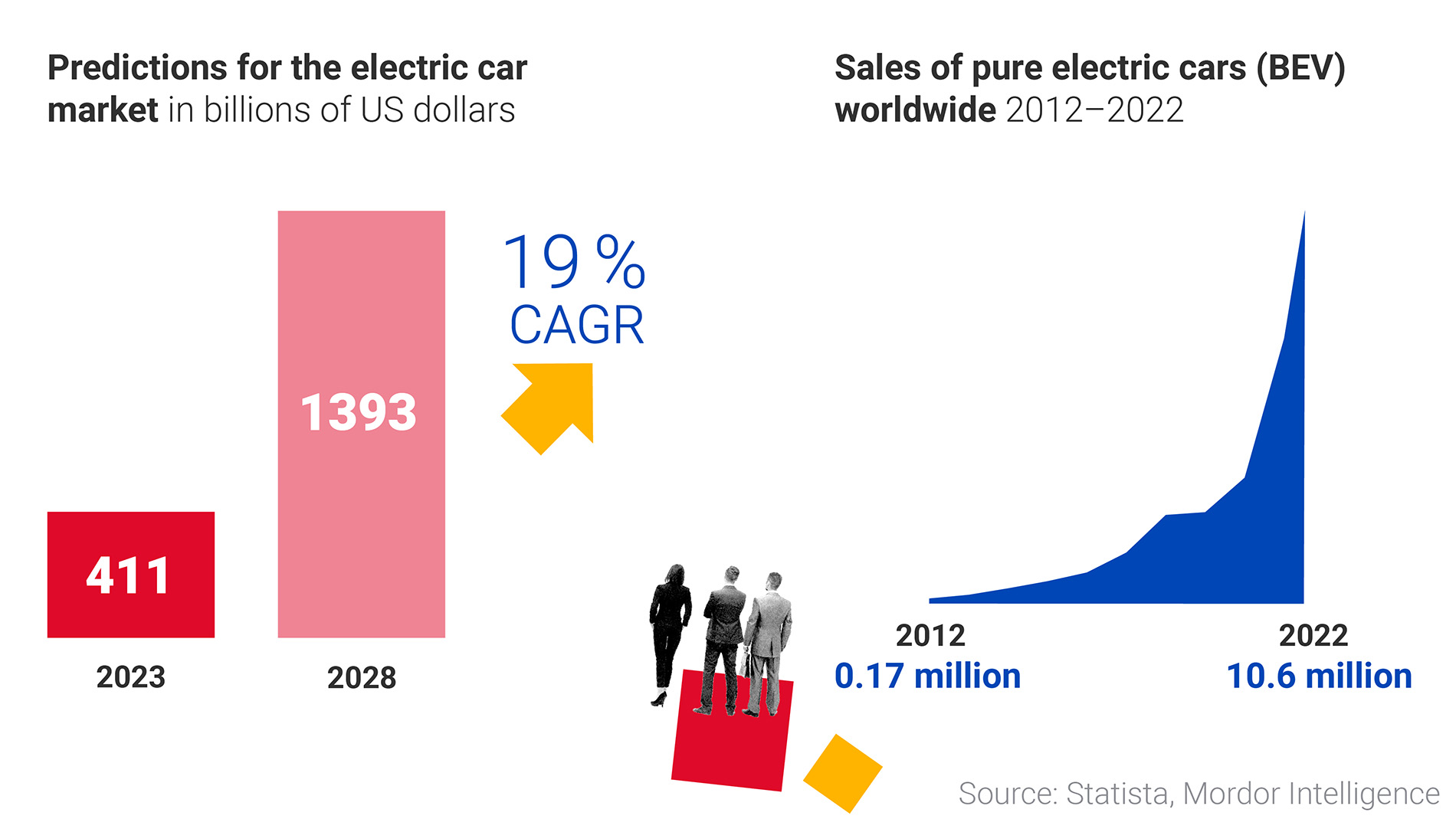

Climate policies provide the impetus for the markets of the future. Emission targets, standards and government subsidies are main drivers in the global proliferation of e-mobility. Additional factors are falling battery costs, increases in range, the expansion of 5G networks, the development of public charging stations and the ‘Tesla effect’. Thanks to Californian manufacturer Tesla, electric-powered vehicles are considered to be in the vanguard, combining high performance (digitality, connectivity) with exciting design and enjoyable driving.

Hybrid as a transitional technology

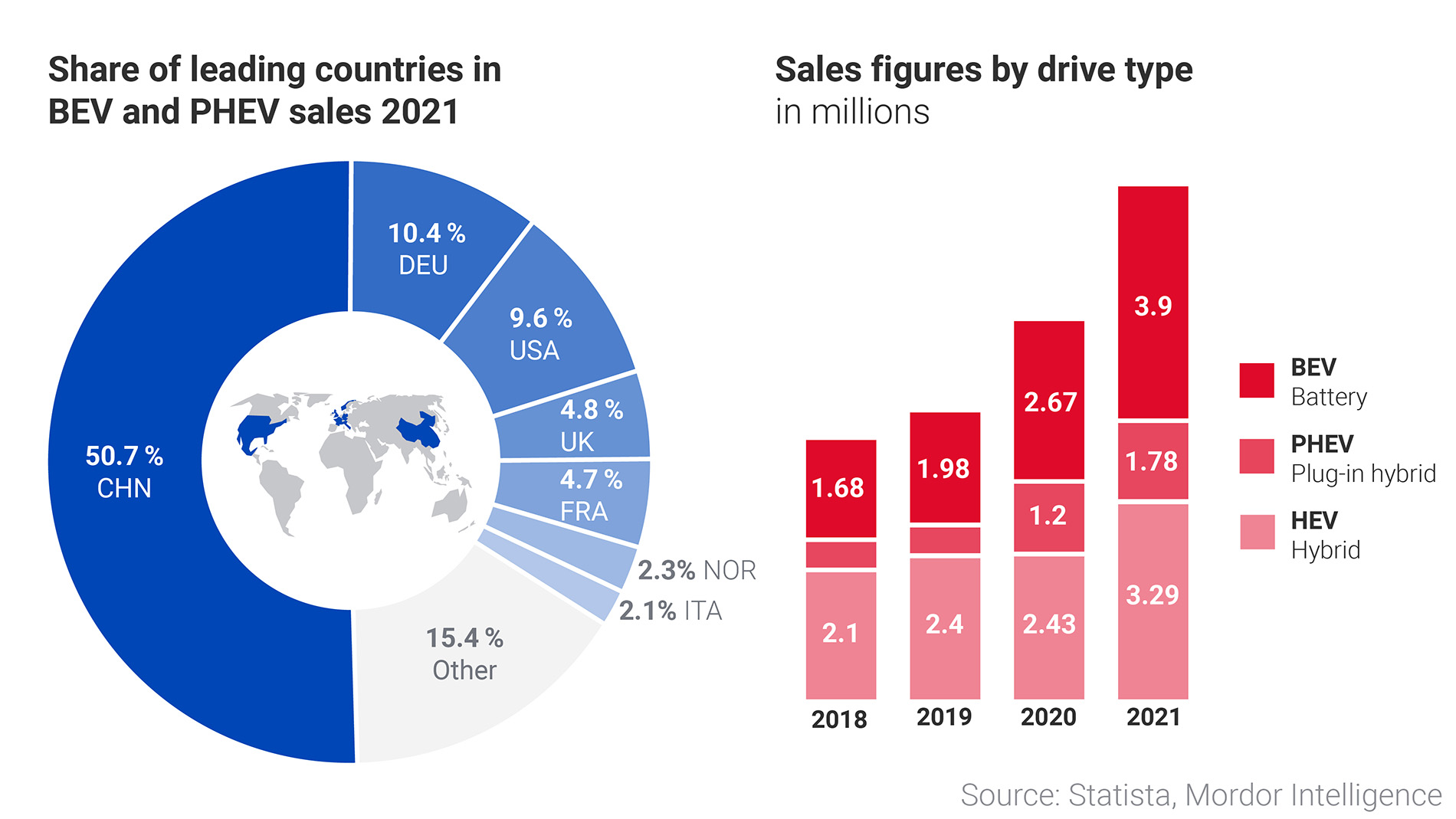

The greatest uptake of electric drives is in China, Europe and the USA/Canada. 96 per cent of new registrations in 2021 were in industrialised, highly developed countries, but emission-free drives are also needed in the global south in particular. Given ‘range anxiety’, plug-in hybrids continue to be a growth segment. However, they are regarded as transitional technology because their efficiency and impact on the climate are lower than purely electric cars and cars driven by green electricity.

“Mass adoption of electric cars in India will not happen unless the gap in up-front prices of electric and ICE vehicles is brought down.”

The battery's competitive advantage

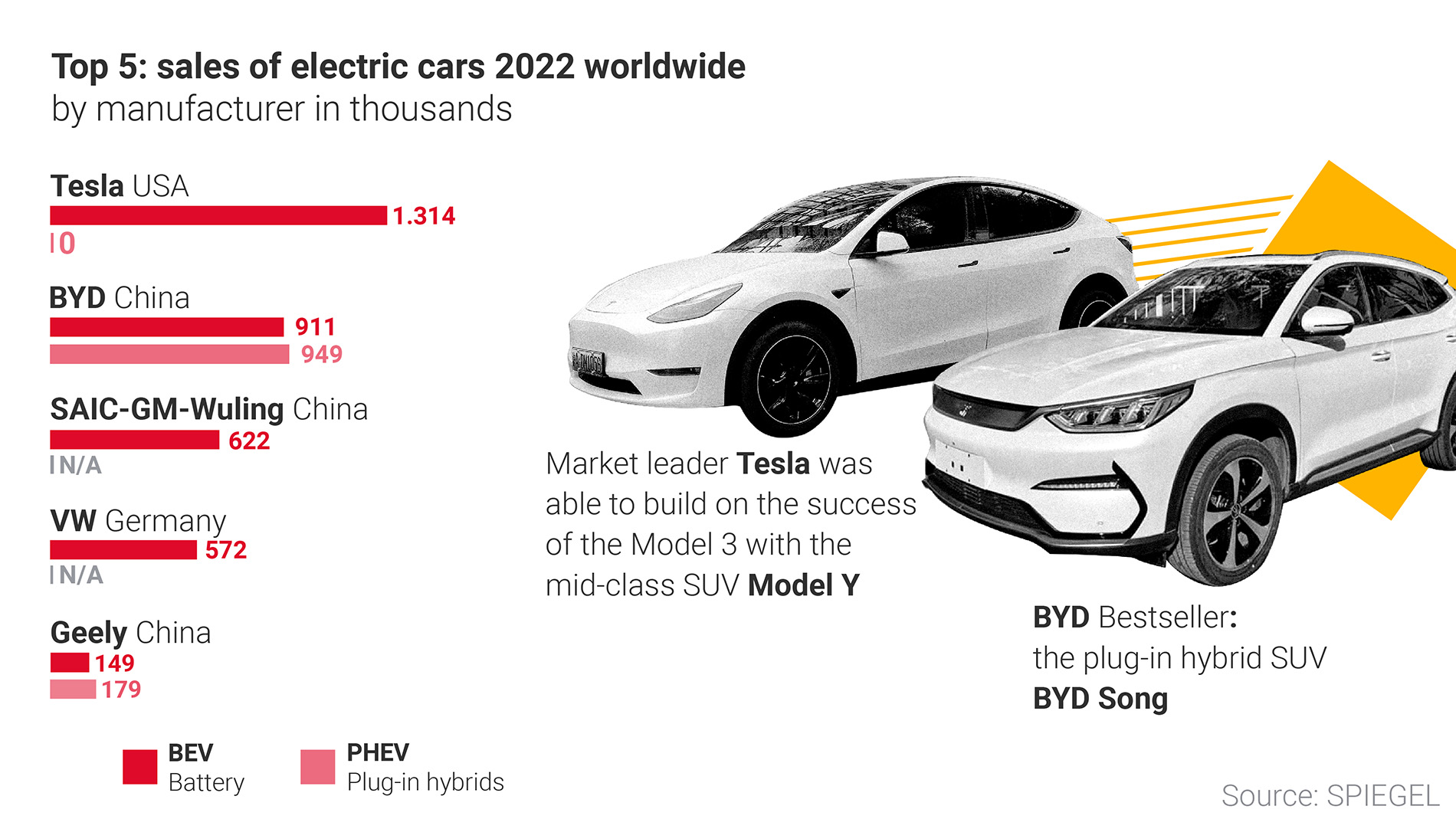

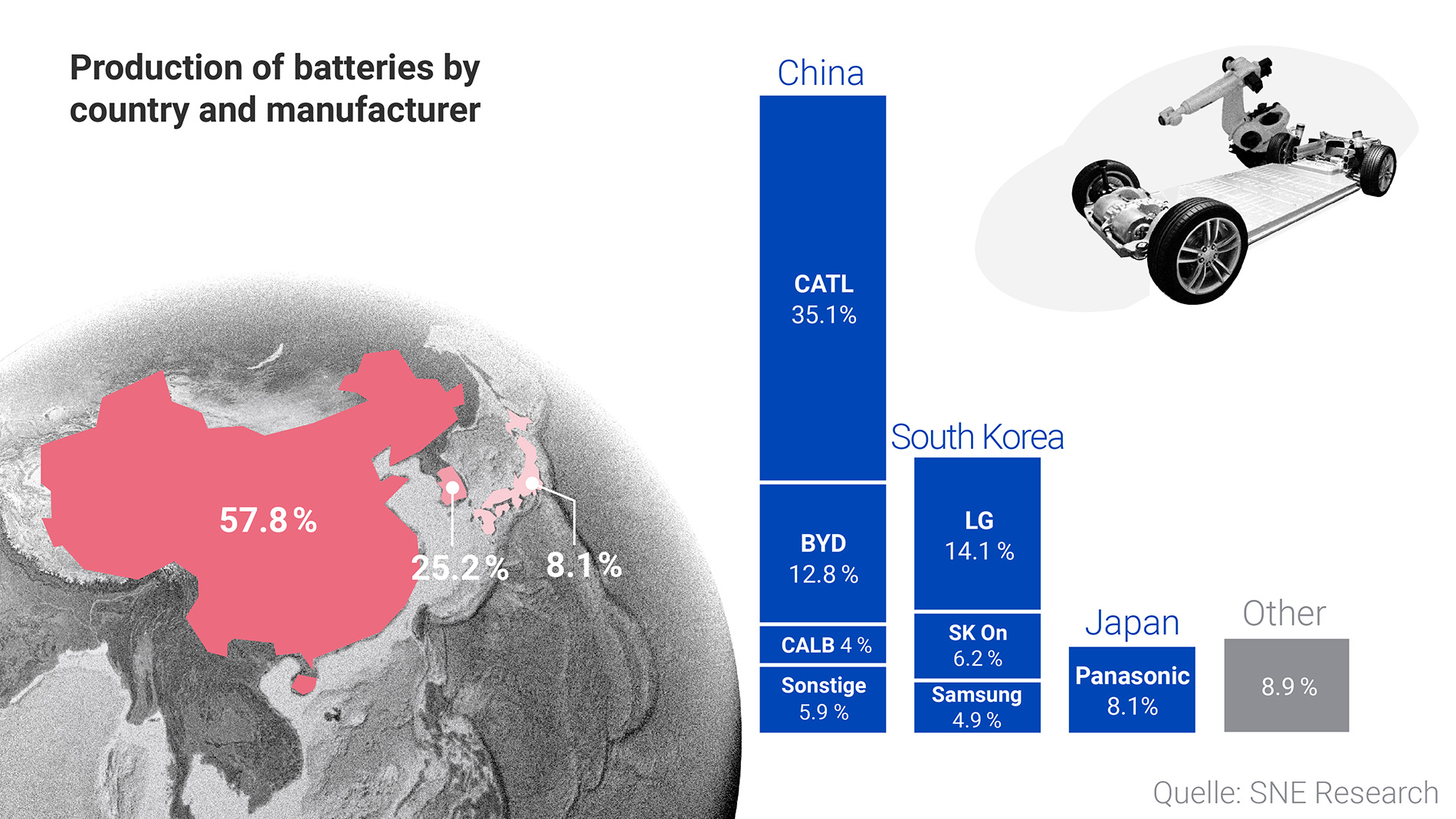

The major competitors with the highest shares are America and China, Tesla and BYD. According to data for 2022, Tesla remains world market leader in electric drives, while BYD is at the top if hybrids are also included. A competitive advantage is if manufacturers have experience with batteries or start to manufacture them themselves as the batteries comprise a high proportion of the value creation. Europe already manufactures 30 per cent of electric cars but only ten per cent of the batteries, and only then their individual components.

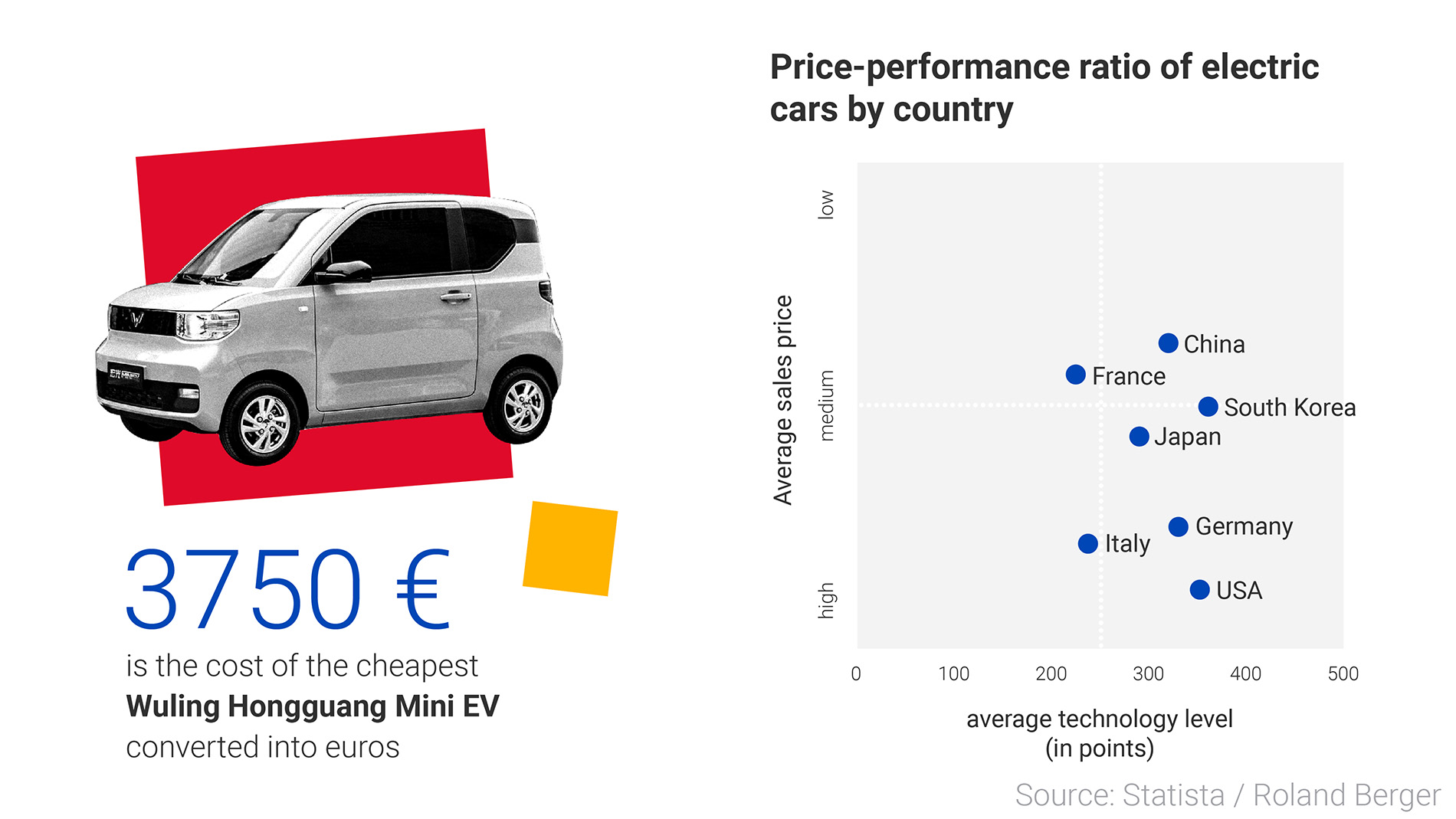

E-Cars cheaper and cheaper

At €3750, the Wuling Hongguang Mini EV by Shanghai manufacturer SAIC is now the world’s cheapest electric car. Electric cars in Europe currently cost an average of 40,000 euros but this is expected to drop to around 16,000 euros by 2030 – a realistic estimate given that battery costs are now significantly cheaper: since 2010, the global average price per kilowatt hour has fallen by 89 per cent from US $1200 to 132. The battery comprises around 40 per cent of the total value of an electric car and therefore largely determines the sales price.

“In total, SAIC-GM-Wuling has now sold 1.11 million MINIEvs by 2022. Our company is already present in more than 40 countries and regions in South and Central America, the Middle East, Africa and Southeast Asia.“

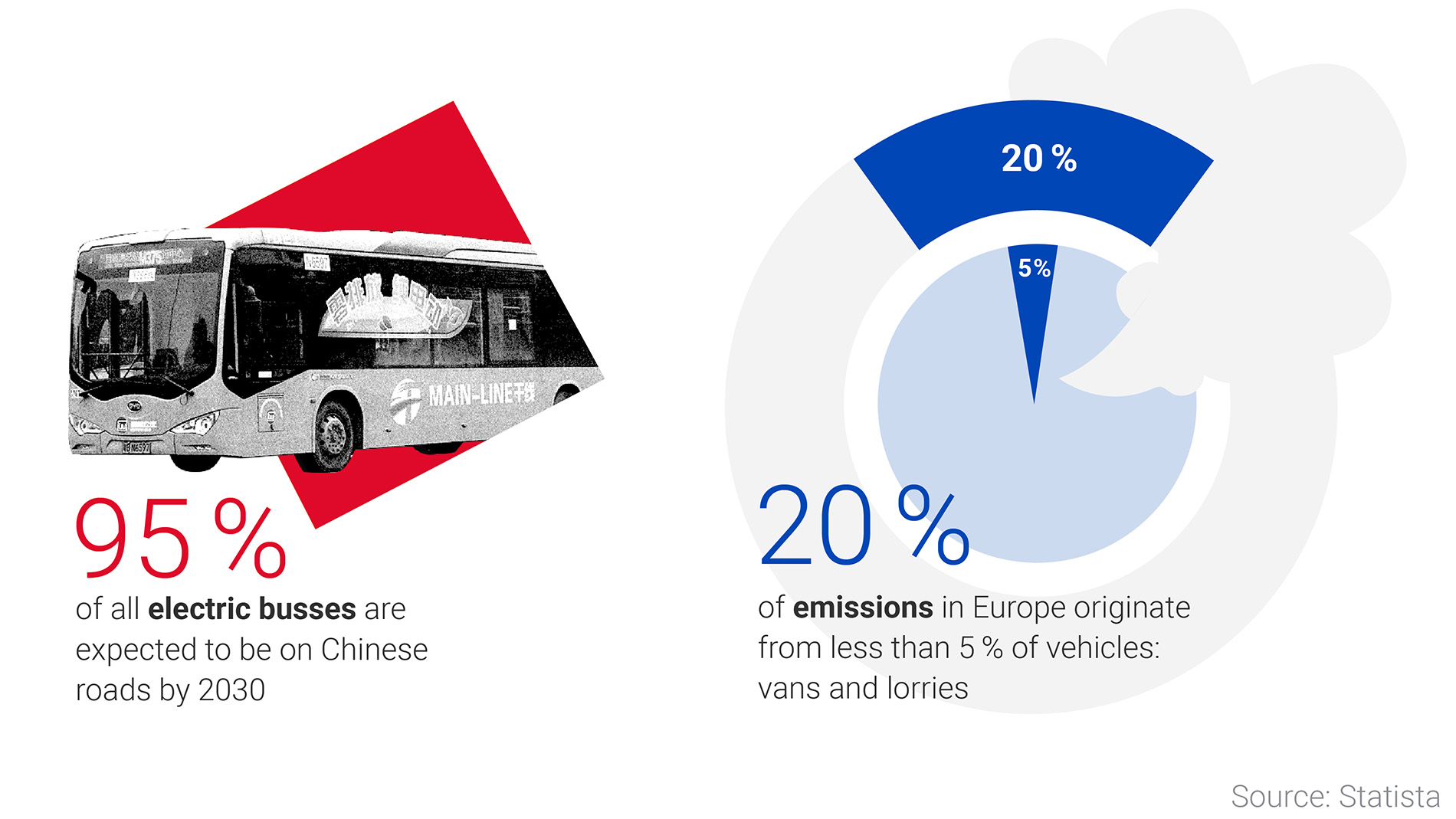

China rides the electric bus

Thanks to urbanisation, the electric bus is one of the most in-demand modes of public transport. There are expected to be 1.9 million buses by 2030, with 95 per cent in China. Cities worldwide are investing in emission-free public transport. Growth in e-commerce is the driving force behind low-emission solutions, such as company-specific electric commercial vehicles. Subsidies are also available when companies switch to e-mobility. Commercial transport offers much potential, especially as it accounts for 20 per cent of transport emissions.

The race for the Euro battery

Production of lithium-ion batteries is the preserve of China and Asia. Europe is thus dependent on this, a situation increasingly regarded as limiting. Sweden's Northvolt is the first European player (stock market value US $12 billion) and has established a joint venture with VW to build European production facilities in various locations. The batteries will be manufactured using 100 per cent green energy from hydropower and recycling – an important differentiation point on the market and a way of reducing the climate footprint of e-mobility.

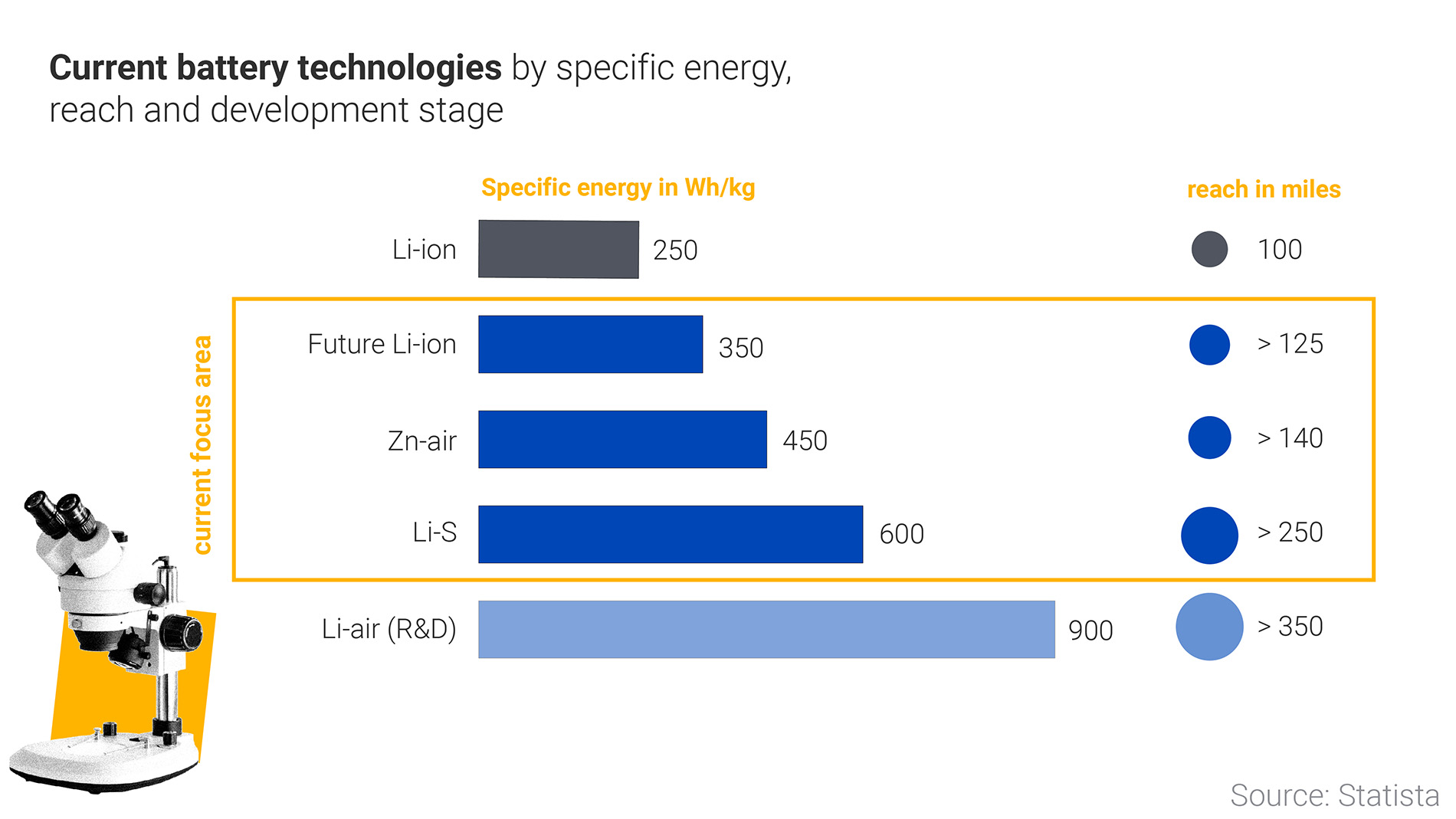

The future of batteries

Cheaper, less weight, greater ranges, fewer critical raw materials – billions are being invested in this. Manufacturers are testing solid state, lithium-sulphur and zinc air batteries, while researchers and start-ups are focusing on aluminium-ion batteries, smart membranes and ultracapacitors. Tesla and BYD use lithium-ion-phosphate battery cells (LFP), which are safer, longer-lasting and cheaper with lower energy density – and do not use nickel or cobalt. The highest energy density and range is achieved by lithium-air batteries from Japan.

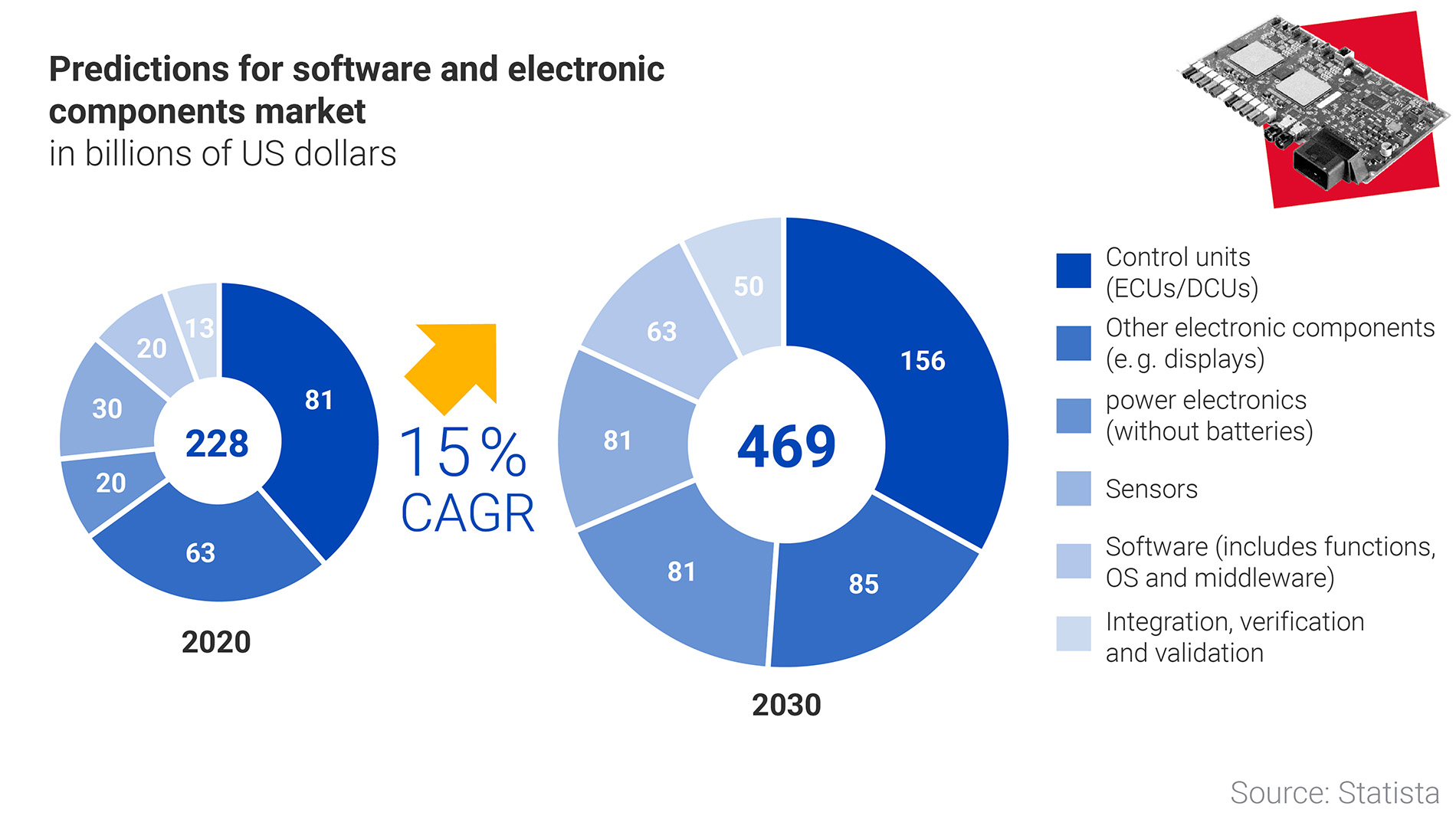

ACES – the new market

Electromobility is more than just a new way to power a drive. In 2017, when the first autonomous vehicles were presented at the Consumer Electronics Show in Las Vegas, almost all were powered by electricity. Connectivity and shared services are standards in both autonomous and electric driving. By charging at public charging stations, electric car drivers have got used to connectivity. Their cars, with a sophisticated electric supply and the small footprint of the motor, provide more space and an unobstructed environment for installing more technology. Categorised by the terms Autonomous, Connected, Electric and Shared (ACES), a market for software and electronic components has developed alongside electromobility and has grown 15 per cent each year. By 2030, it is expected to be worth US $439 billion and offer products for all vehicle categories.